People trust DgNote

3000+

Satisfied Customers250k+

Policies Issued100%

Customer SatisfactionWe are one of India's largest insurance marketplace

Find top marine insurance plan with DgNote

Marine Insurance you can trust

What is marine insurance ?

What are the Types of Marine Insurance Policies?

Hull

protection

Read more

Cargo

insurance

Read more

Freight

insurance

Read more

Indemnity

and

protection

insurance

Read more

War

risk

insurance

Read more

Liability

insurance

Read more

Duty

insurance

Read more

What are the Types of Plans under Marine Insurance Policy

Open marine insurance policy

Features of Open Policy-Inland

Features of Open Cover - Import and Export

Specific marine insurance policy

Features of Specific Policy

Why is Marine Insurance Important?

Marine insurance is crucial for a number of reasons, such as:

Marine insurance covers damages or damages to vessels, freight, and other maritime risks, helping to reduce financial damage that would otherwise have to be incurred by the insured.

The maritime sector is exposed to a variety of dangers, including piracy, weather-related damage, and collisions with other vessels. For people working in the business, marine insurance may assist control these hazards and give them peace of mind.

Maritime insurance can assist in facilitating international trade by giving buyers and sellers the confidence that their commodities will be covered during transit. This can help lower trade barriers and boost economic growth.

Why is Marine Insurance Policy Important?

Following are some major points that highlight the importance of a marine insurance policy:

Marine insurance policies offer protection against monetary losses that may result from damage to the ship or its cargo, liability lawsuits, or lost wages as a result of delays or other problems. Without insurance, these losses may be sizable and might even jeopardize the company's capacity to make money.

A marine insurance policy aids companies in controlling and reducing the risks involved in marine operations. Businesses can minimize or reduce the chance of losses by recognizing and evaluating the risks, and insurance coverage offers a cushion in the event of unanticipated catastrophes.

Based on the kind of vessel, the cargo, and other considerations, marine insurance coverage can be customized to the unique needs of the business. This enables companies to properly control their insurance costs and acquire the right level of coverage.

In the case of a covered loss, a marine insurance policy offers financial assistance to companies to aid in their recovery and ability to continue operations. In order to help with the complaint process, the insurance provider can offer knowledge and resources, including determining the severity of the harm, setting up replacements or repairs, and expediting claim settlement.

What are the Important Features of Marine Insurance Policy?

Coverage

Read more

Deductibles

and Premium

Read more

Value and

appraisal

Read more

Navigation limits

Read more

Loss prevention and control

Read more

Claims processing and settlement

Read more

Risks included and excluded in a marine insurance policy

Risk coverage depends on the coverage clauses, but standard insurance policies will typically cover below risks or perils:

| Coverage Description | All Risk | Basic Risk |

|---|---|---|

| Lightning | ✓ | ✓ |

| Breakage of Bridges | ✓ | ✓ |

| Collision with or by the carrying vehicle | ✓ | ✓ |

| Overturning of carrying vehicle | ✓ | ✓ |

| Derailment or accident or like to carrying vehicle/railway wagon | ✓ | ✓ |

| Non delivery of entire consignment or packets | ✓ | ✓ |

| Theft, Pilferage | ✓ | ✗ |

| Fresh and Rain water damage | ✓ | ✗ |

| Damage by hooks, nails, oil, mud, acids and other extraneous substances | ✓ | ✗ |

| Any other risk not specifically excluded under the policy | ✓ | ✗ |

Excluded coverage, risks or perils not covered by an marine insurance policy:

To comprehend the precise risks that are included and excluded, it is crucial to carefully analyze the policy. Also, certain endorsements or provisions in policies may change the cover or exclusions. Acts of war, conflicts, or terrorism are not covered risks unless specifically covered by the policy

Standard Terms and Conditions Covering Marine Insurance Risk:

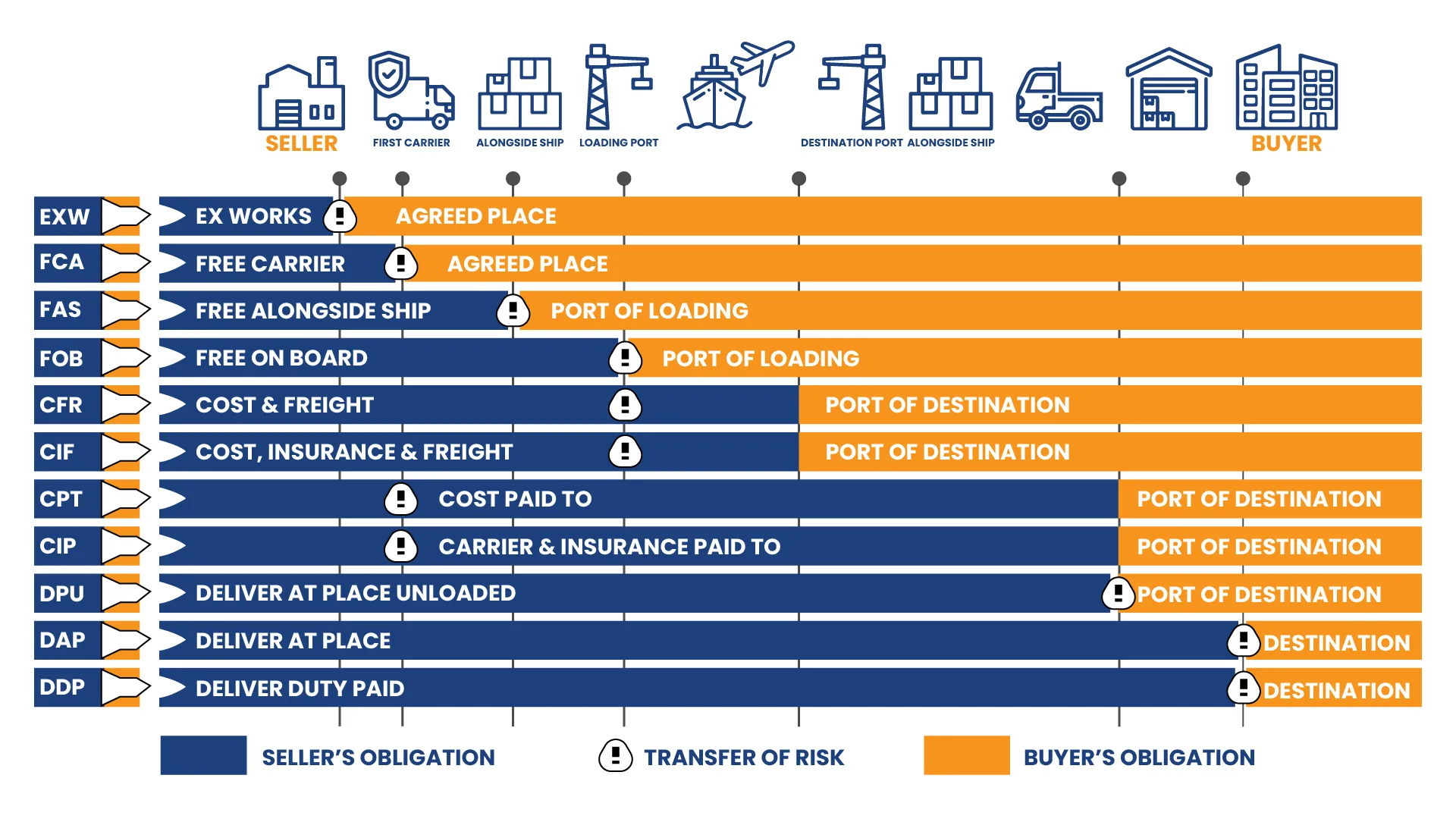

What are INCO Terms?

Connect With Us & Get It Resolved